The Consulting & Technology division of Davies has been monitoring NPS (Net Promotor Score) and Customer Effort Score (CES) for the past 6 years across a basket of around 20 GI brands. The data for Q1 highlights the pressure that claims teams have been under after winter storms, increased traffic levels and pressures on resource. Despite well-rehearsed catastrophe plans there were still significant challenges at that time because of sickness, self-isolation, lack of available contractors etc- all of which will have meant delays and depletion of service. Unfortunately, customers’ patience with such issues has diminished to a point we’ve not seen before.

What did we find?

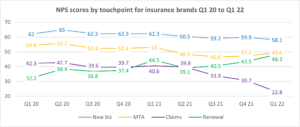

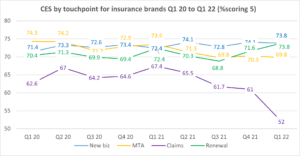

The NPS and CES scores we measure are based on transactional feedback (i.e. feedback soon after the customer has had an interaction with the company) from customers at the primary touchpoints of new business, mid–term adjustment, claims and renewal. Our clients use these data to drive their operations and customer experience strategies.

The latest set of results for Q1 2022 paint a depressing picture for claims performance. The pattern of decline that we saw across all four quarters of 2021 has accelerated with Claims NPS dropping like a stone from 30.7 in Q4 21 to 22.8 in Q1 22 – the biggest single quarter decline we have seen.

Meanwhile NPS scores at other touchpoints have remained steady or improved.

The trend for Customer Effort Score shows a similar decline in claims while scores across new business, MTA and renewal remain stable.

Why is customer satisfaction dropping?

Looking at the comments that detractors have left about their claims experience it is apparent that companies are struggling with a combination of increased volumes of claims and staff/process shortcomings. Too many comments reference the time taken to resolve claims, poor communication processes (i.e. failure to keep customers informed) and being passed from “pillar to post” with no one individual taking ownership of a customer relationship. Lengthy call response times are also a common bugbear.

What is clear is that customers no longer accept that the pandemic is a valid reason for poor customer experience. There is an expectation that companies should by now have learned to live with the virus (even though many companies will have suffered from staff absences due to Covid in the first quarter of the year).

Consumer attitudes have hardened

Insurance customers are not prepared to give companies the benefit of the doubt. With the lifting of all domestic covid restrictions on 24th February government and employers have asked the public to return to normal. People expect insurance companies to resume normal service despite the pressures they face in respect of increased volumes of claims and reduced staffing levels.

Attitudes have been further sharpened by pressure on household budgets because of the cost-of-living crisis. It’s a perfect storm for the insurance sector that shows few signs of abating.

Thomas Cowper Johnson

Insight Director

E. thomas.cowper-johnson@davies-group.com

L. https://www.linkedin.com/in/thomas-cowper-johnson-1599125/