AML Suite

Versatile and secure AML compliance that goes beyond the basics

AML Suite

Versatile and secure AML compliance that goes beyond the basics

One thing’s for sure, Anti Money Laundering regulations do not remain static and neither should your compliance solution

It’s time to accelerate and transform your AML processes. Our AML compliance solutions have been designed to help you stay on top of your regulatory obligations.

£146m in fines for UK regulators in 2020 for AML compliance breaches.

AML compliance that protects you against all odds

To avoid criminal exploitation and regulatory fines, it is vital to ensure that your AML procedures are bulletproof.

Any sign of weakness or insufficiency of the process can unwittingly give fraudsters a path to launder money at your expense.

Our Anti Money Laundering solutions can help you to build a long-lasting fort of protection against corruption through access to top-quality data feeds.

How our AML compliance solutions can help:

- Manage risk and avoid reputational and financial damage.

- Implement proactive and preventative AML compliance measures to protect your client relationships and trade.

- Ensure that you fully comply with current regulations whilst retaining optimum security.

- Inefficient client onboarding can be pricey.

- We’ll help you improve tired and out-of-date workflows, expedite data processing, and create slicker onboarding experiences to generate client growth.

- With our AML solution, you can simply digitalise your mandatory client due diligence, AML, and KYC processes to achieve exceptional customer experience.

- Risk assess new and existing customers with ease.

- Screen and monitor applicants against a range of integrated data sources for maximum security and protection.

- Make sure that your ongoing due diligence and customer risk management processes remain fully secure and efficient.

Combat crime and guarantee compliance with our Anti-Money Laundering technology

AML Checks

Make sure that you’re always dealing with the right people with rapid client identity and address validation.

Our Anti-Money Laundering Suite provides options for both identity proofing and verification of:

- Global ID Validation

- UK Address Verification

- Bank Account Verification

- Biometric Liveness Check

- Authenticate identity documents

PEP and Sanction screening

Conduct a thorough risk evaluation for your business with our PEP and Sanction search tool.

Includes options for integrated or standalone checks:

- WorldCompliance PEP register (UK domestic and global)

- Global sanctions list (HMT, EU, OFAC)

- Ongoing monitoring

Source of funds

Always be confident that funds come from a legitimate source.

Our Proof and Source of Funds tool is an intelligent and efficient alternative to chasing client bank statements.

Delivering:

- Open-banking technology

- Consolidated bank account data

Batch AML screening

Fast-track your batch onboarding process while meeting AML compliance standards.

We can help you to rapidly screen and regularly check applicants across multiple databases in accordance with UK AML regulations.

Benefit from:

- AML remediation

- AML screening against multiple third-party lists

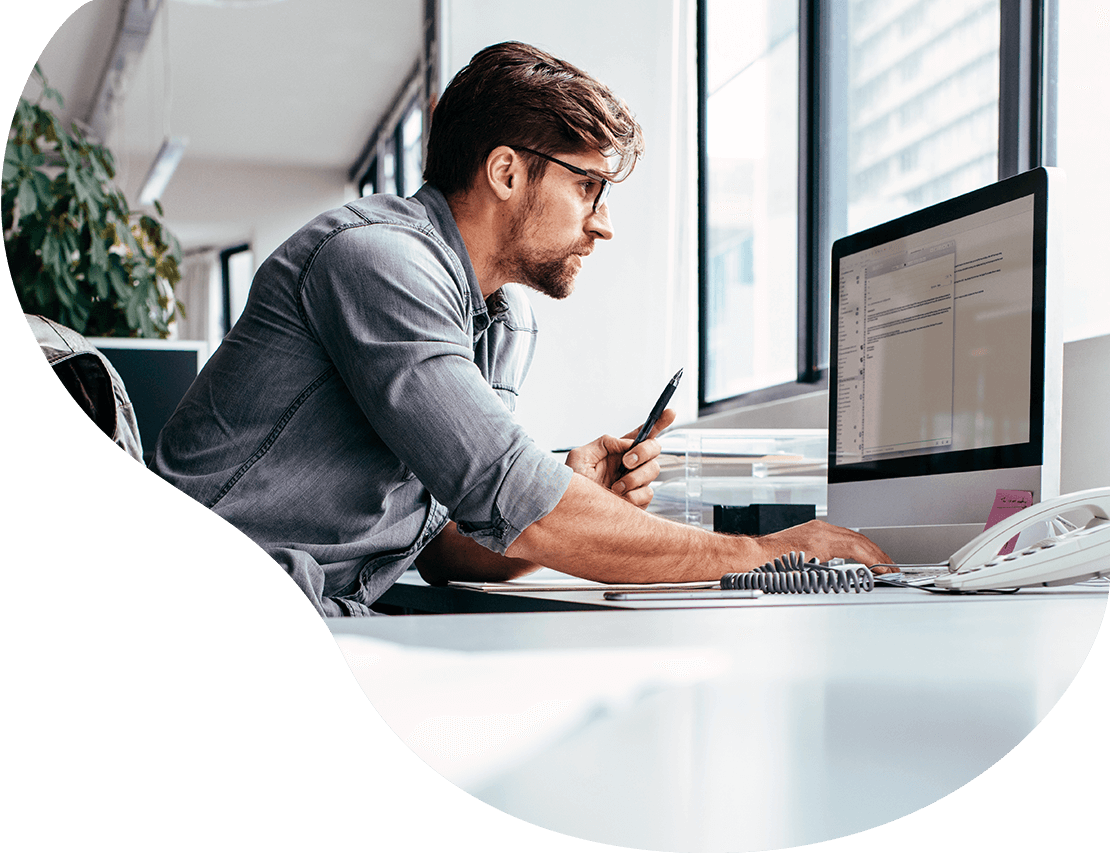

Give your business the boost it needs with our adaptable API

An effective AML compliance regime is an absolute necessity for any regulated entity to satisfy both the regulations and their clients.

This balancing act between compliance and client experience means that every organisation has unique requirements.

Our flexible API allows you to choose the best-fitting solutions for individual client touchpoints.

Our team of experts will work with your compliance team to shape the best technical and commercial fit for you, with three clear goals in mind: boost your customer onboarding experience, underpin a healthy client relationship, and unlock accelerated revenue flow.

Fill in your details via the button below and we'll be in touch.