InsurTech

Compliance for the insurance sector

InsurTech

Compliance for the insurance sector

Our InsurTech solutions can help safeguard your insurance firm from fraud, ensure FCA guidance compliance, accelerate revenue streams, and power express client onboarding.

“£1 billion+ cost to UK annually in insurance fraud.”

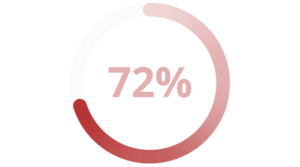

“72% of respondents would like all-digital onboarding systems.”

We can help insurance firms…

- Halt fraudulent claims in their tracks through superior client identity verification

- Gain a competitive advantage through superior client onboarding and experience

- Maintain ongoing compliance through access to market leading data sources

Helping mitigate the risks of insurance fraud

The insurance industry is at increasing risk of exploitation by money launderers, especially those which offer life insurance policies.

Insurers are also vulnerable to fraudulent claims. Making robust risk-based procedures to verify client’s identity quickly and efficiently a necessity.

With our client verification range, we can help you to avoid AML and CFT risk, giving you the systems and controls needed to protect against financial crime and fraudulent claims.

Our solutions include PEP and Sanctions monitoring capabilities for change in status updates for your ongoing customer risk assessments.

Protect your business and deter fraudsters with our compliance range.

Discover more

Providing rapid KYC checking for a superior client experience

Adapting to consumer expectations of a quick and simple onboarding process is vital for business survival.

Inefficient onboarding is costly, runs the risk of high application drop-offs, and a loss in competitive advantage.

We offer instant ID check results against multiple databases to ensure robust due diligence.

Instantly run desired checks upon initial application with trusted information returned via a collated report for fast decision making.

Reduce friction and onboard clients faster.

Discover more

Who do we help?

Our far-reaching of solutions have helped many kinds of insurance firms including:

- Life insurance

- Investments

- Trusts

- Pensions

Get to know our versatile and adaptable API for the insurance sector

Instigate a powerful risk-based regime and avoid exposure to insurance-focused financial crime – as well as the potential penalties – with our dedicated API.

Our experienced consultants will work with your compliance team create the best technical and commercial model for your business needs.

Enhance the client onboarding experience and accelerate business growth with our integrated solutions.

Drop us your email address and we will get in touch.