KYC Suite

Powerful digital solutions for KYC compliance

KYC Suite

Powerful digital solutions for KYC compliance

With our KYC compliance suite, sophisticated screening makes sure that you always know exactly who you’re dealing with and client onboard is managed with maximum efficiency.

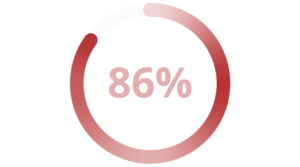

86% of new customers report higher levels of loyalty to companies which invest in onboarding processes.

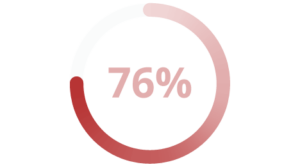

76% of those surveyed view identity theft as a serious problem in the UK.

Our KYC verification tools are designed to mitigate risk and optimise the client experience

KYC compliance is critical to your customer risk assessment. Our compliance tools enable you to strengthen your defense against identity fraud whilst protecting your customer onboarding experience with our electronic verification range.

KYC provides an efficient and seamless solution. Impress your clients at primary touchpoints and reduce your first-time failure rate.

Find out how our KYC compliance suite can help you

Our compliance suite has been developed with your needs in mind. It helps:

To maintain compliance, you need to know your client.

KYC checks are designed to strengthen your customer risk management processes, reduce the risk of identity fraud and deliver exceptional customer experiences.

Let us help protect your business from unsuitable applicants and ensure that valuable customers are onboarded faster.

Explore our compliance and risk management range.

Customer experience is all about keeping pace with client expectations. You need to be able to adapt to the requirements of the digital consumer to not only gain a competitive edge in your marketplace but differentiate your brand.

Our solutions enable you to reduce the burden of mandatory risk obligations, whilst quickly verifying client information to achieve faster onboarding which helps to elevate levels of customer satisfaction.

Explore our client onboarding range.

Our KYC Suite

ID Checks

With our KYC products, gain access to authoritative data sources and customer-controlled mobile checking options.

Benefit from:

- ID Validation – with our robust check service

- Quickly assess and validate client identity and address with:

- Global ID validation

- UK address verification

- Bank account verification

EIDV – Our advanced KYC solution

Gain seamless onboarding with on-the-go identification

- Biometric liveness checks

- Facial recognition technology

- Document capture and authentication

Benefit from our versatile and adaptable API

An effective KYC compliance regime is an absolute necessity for any business.

It can help you manage risk, enable compliance and above all, impress the clients you want to impress.

Our flexible API allows you to choose the solutions for individual client touchpoints, giving you the power to select the checks that best fit your business needs.

Our consultants can also advise on your operational requirements, helping you to make the most of unique first-impression interactions by exhibiting clear customer experience understanding and leveraging digital optimisations with our KYC suite.

Fill in your details via the button below and we'll be in touch.